RMA Online

Risk Maturity Self-Assessment

Ansvar has developed an online risk maturity self-assessment tool (RMA Online) to assist organisations in better understanding where they are on their risk management journey, assess the effectiveness of their risk management framework and help identify areas for improvement.Ansvar RMA Online:

- Is developed by risk experts in your sector

- Is an easy to use self-assessment tool helping you to evaluate the effectiveness of your organisations risk governance, risk processes and risk resources

- Provides a tailored risk maturity report, a risk maturity score and helps identify risk framework strengths and improvements

- Is available at no charge

Benefits of RMA Online

Our RMA Online guides you to assess your risk management by looking at it in 3 ways:

Risk Governance, Risk Processes and Risk Resources.

After completing the RMA Online, you will receive a tailored report that includes:

RMA Information & FAQs

What is Ansvar’s risk maturity self-assessment (RMA Online)?

Ansvar’s RMA online is built by risk management experts who specialise in the sectors we insure. A comprehensive risk maturity model is brought to life by our easy to use tool. You will be provided with a risk maturity score, your risk maturity level, overview of positive features of your current approach and a tailored set of recommended improvements.

What is risk maturity and why measure it?

Risk Maturity is a point in time measure of the progress of an organisation’s risk management framework. Maturity is generally considered to increase when the framework becomes more effective, there is appropriate capabilities to lead it, is fit for purpose and supports good governance.

An organisation’s risks are dynamic and frequently changing. It is important to ensure that the risk framework continues to meet the needs of an organisation and to identify if any strengthening of the framework is required. Risk maturity is a continuous improvement concept. Conducting a risk maturity assessment helps monitor the overall state and progress of your risk management framework and to guide establishment of a ‘risk improvement plan’.

How long does the online assessment take to complete?

It will take approximately 60 minutes to complete the assessment if you have access to all of the information and knowledge of your organisation’s risk framework. We encourage you to engage others in the process so that you are maximising experiences and perspectives on risk management. You can start, stop and save at any time.

Do I need to pay for the RMA Online?

There is no charge, the assessment is available to everyone via the Ansvar website.

Will the took work on a mobile phone or iPad?

Yes, the assessment can be undertaken on a laptop, iPad and mobile phone.

How many levels or risk maturity are there?

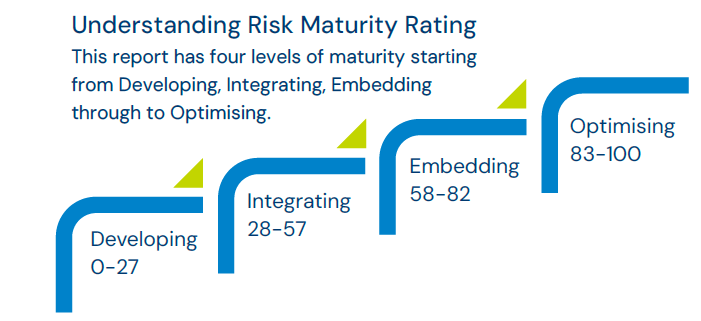

The RMA Online has four levels of maturity

- Developing – the organisation is at the start of its risk maturity journey and is developing risk management arrangements.

- Integrating – the organisation is making progress in integrating risk management into the organisation’s culture, planning and operations.

- Embedding – the organisation is seeing tangible and material benefits from embedding risk management throughout the organisation.

- Optimising – the organisation’s risk framework is optimising the value of risk management and producing material benefit to the organisation.

How do I improve my risk maturity score?

After you complete the self-assessment, you’ll be provided with a list of suggested improvement opportunities for you to review and use to create an action plan.

What is the right level of maturity for my organisation?

Not every organisation needs to be at the highest risk maturity level. It is important that your organisation determines the right level of maturity that suits your circumstances and the level of risk you must manage or intend to pursue.. For example, some organisations may choose to remain within the “integrating” range of maturity, but continue to improve so that it remains within this level of maturity and can continue to manage its risks effectively.

Is there a user guide on how to use RMA Online?

The RMA Online User Guide can be found below. If you still need help, please contact the Ansvar Risk team at info@ansvarrisk.com.au.

How often would you recommend an organisation completes the assessment?

We recommend annually or following a material change within the organisation, or in response to an ad hoc request – it’s up to you! But be mindful that maturity takes time. Trying to rush improvement can push risk management into a compliance “tick-box” approach. Previous assessments will be stored for comparison purposes.

What happens if the person who is registered leaves my organisation?

Each assessment is registered to the person who originally registered to use it. Registrations cannot be transferred or shared with any other member of the organisation. We recommend users download reports so they can be shared accordingly to measure changes in risk maturity over time.

How is the data used?

Registration data is managed in line with Ansvar’ s privacy policy and associated Australian regulatory requirements.. Ansvar will use aggregated data collected over time from all participants to tailor our risk management products and programs for our client sectors. The data also will assist with benchmarking reports overtime.

Will information be shared with Ansvar Underwriters?

The information submitted will not be shared with Ansvar’s Underwriting team and will not impact individual premiums.

Can a broker complete the RMA Online on behalf of their client?

No, the assessment is designed for completion by those in an organisation that have knowledge of risk governance, risk processes and risk resources.

If I need support with completing the RMA Online, who should I contact?

Contact Us button or email Ansvar Risk at info@ansvar.com.au to be in contact with one of our Senior Risk Consultants.

What is Risk Maturity Self-Assessment Online?

What is Risk Maturity Self-Assessment Online?